Buy Now Pay Later: The Past, The Present And The Future

While in-store customers only tend to expect basic payment methods like cash, credit, or debit card, it’s an entirely different story for digital purchases where diverse payment options are the norm. Without the ability to accept different types of payments, your customers may begin to gravitate toward your competitors. One payment integration that keeps customers in your shop is "Buy Now Pay Later" (BNPL).

History of BNPL

Buy Now Pay Later solutions began with Singer Sewing Machines. In 1840, the company began offering their sewing machines for a "dollar down, dollar a week." Though it began as a clever marketing tactic, other industries saw the value in the

Retail industries like furniture, pianos, and farm equipment began using business payments to make their expensive products more accessible to consumers. This decision extended once unattainable luxuries like new furniture to members of lower-income groups. The result was increased retail sales and increased consumer satisfaction, proving that BNPL created a symbiotic relationship between retailer and customer.

Popular e-commerce BNPL services and how they work

Although credit cards were once the preferred option for purchasing, they’ve seen a steep decline in use due to high-interest rates and declining credit limits. Enter BNPL services, which offer little-to-no interest rates on the payment installments, with small, short-term loans and reduced (albeit to some controversy) credit checks. These include but are not limited to:

-

Klarna

-

Clearpay

-

Affirm

-

Apple Pay

-

Shop Pay installments

-

Afterpay

-

Paypal

Incorporating these into your e-commerce store means, in addition to selecting a credit, debit, or gift card, customers will be able to select whatever BNPL option you offer. Once selected, the service will prompt them to fill out a credit application.

The provider will then perform a soft credit check. If approved, they agree to a term with the BNPL provider (typically 3 to 4 payments). They make their purchase with your store and pay back the loan with the provider over the course of their term.

Adding BNPL to your e-commerce store

Adding different BNPL services to Shopify is simple and streamlined. You can add a BNPL provider to your checkout in a few quick steps:

-

Go to Settings > Checkout

-

Click on "set up a payment gateway"

-

Select "buy now pay later"

-

Fill out the form with your merchant ID

-

Submit

Before you integrate your Shopify store with a BNPL option, you should take a few things into consideration. The following factors may impact your use of BNPL and your chosen service.

Payment options available on Shopify

Shopify has a native BNPL app called Shop Pay. Introduced at the end of 2020, Shop Pay allows U.S. merchants to offer BNPL to their customers while still receiving the full payment for their merchandise. However, merchants don't have to use Shop Pay—other BNPL options integrable to Shopify are:

-

Affirm

-

Klarna

-

Afterpay

-

Clearpay

-

Charge Me Later

-

Splitit

Of course, PayPal is also compatible with your Shopify Plus store. However, PayPal has more services to offer than just BNPL (Paypal Pay in 3), and when using Paypal, customers are redirected through the Paypal app. Therefore, PayPal is its own type of payment gateway.

Conversion rate effects of incorporating BNPL

On average, online cart abandonment rates sit at 68.8%. According to the Baymard Institute, most of these shoppers bounce because of high costs, and 9% even cite a lack of payment options.

Therefore, increasing the types of payments with BNPL can encourage shoppers to make the purchase twofold. First, they worry less about dropping a lot of money at once. But, they also have the peace of mind of paying on their own terms.

How different industries benefit from BNPL

Like the automotive and farming industries of BNPL's infancy, industries that sell big-ticket items find BNPL most useful. Merchants that sell expensive products continue to open up their customer base by allowing customers to pay in installments. Such industries include:

Electronics

HyperX

Furniture

Olivia's

Luxury goods

Paul Valentine

Appliances

Bosch

However, BNPL isn't just for the big brands, even if you're a smaller store, the increasing popularity of BNPL options means shoppers will come to expect to see BNPL options, and if they don't - you could risk losing the sale. But, spreading the cost of purchases isn’t always the driving factor for customers choosing BNPL options at checkout. Returns also play a role.

In fashion, a BNPL or deferred payment option gives the customer flexibility to try on clothes at home without having to outlay a large sum of money. The consumer can then return the clothes they don’t wish to keep or continue with payments for the items they wish to keep.

BNPL Considerations

BNPL isn't right for every business. Some considerations may make or break whether you should adopt BNPL for your Shopify store.

International

Many BNPL providers only work in specific countries. So, stores that do a lot of international business may not see the full scale of BNPL benefits. Payment terms will differ depending on the region that you’re selling into. For instance, in the UK - payment terms are likely to be monthly - as the average consumer gets paid on a monthly or 4 weekly basis. In the US, however, the average consumer is paid fortnightly - so payment terms should reflect that.

However, there are BNPL providers specific to certain countries and regions, for example, iDEAL is the preferred BNPL option for The Netherlands, and AfterPay is the preferred one in Australia. On Shopify Plus, you can seamlessly integrate the common BNPL options to your country-specific stores, which will save you the challenge of trying to make one BNPL provider work for a global customer base. Using a Payfac like Mollie modifies which payment options are available to the customer depending on their location, creating a seamless experience.

Pay in 4 vs. Pay in 3

BNPL services offer loans in terms of three or four payments. Some offer customers the option of choosing the term, while others only offer one or the other. You should consider how important flexibility is to your customer base before integrating certain BNPL offerings.

Return Rates

Up to 70% of BNPL purchasers admit to buyer's remorse and want to make returns.

Merchants that rely on just-in-time ordering may need to rethink their business processes in order to counteract the increased return rates often associated with BNPL consumers.

Some BNPL services don't have the same connections to retailers as credit card companies do, so the return process isn't always instantaneous. The frustrating process of contacting both the retailer and loan provider may turn customers away from using BNPL. Ensuring you have a quality FAQ and customer service set up will help combat this frustration.

Profitability and Fees

BNPL services offer loans with 0% interest—so how do they stay in business? This often comes down to charging the retailer a fee. As a retailer, you should consider how these fees affect your bottom line and whether the profits you see from increased conversion would surpass the amount you spend on service fees.

Education

Though it's growing in popularity, the average consumer isn't as familiar with BNPL as they are with traditional credit cards. Don’t lose long-term customers over a bad BNPL experience. Ensure your website's FAQ page covers BNPL-related inquiries.

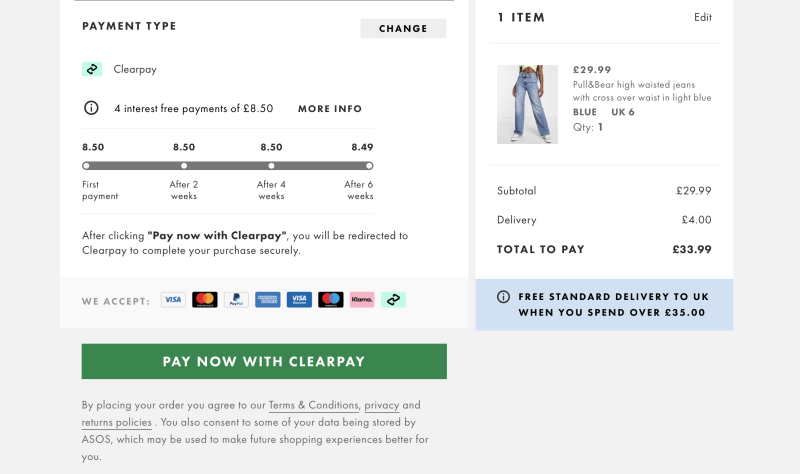

As a merchant, it’s up to you to educate your consumers on your BNPL options - you can do this by adding the split payment breakdown on the PDP, clearly displaying the options throughout the user journey, and using your communication channels such as email, SMS, and social media.

ASOS split payment breakdown for BNPL option - Clearpay

Normalizing debt

BNPL services face criticism over the normalization of debt. As the average person has more debt than ever before, consumers might interpret your offering BNPL as contributing to the problem. If your audience is likely to be critical about utilizing BNPL, then it may not be a viable option for you - doing consumer research will help you decide if this will be an issue.

Lack of regulatory oversight

While there are some regulations now introduced in the UK, BNPL services still don't have the same oversight programs as credit cards. The lack of consumer protections could hurt your customers and give them poor impressions of your brand. Thankfully, if you work with a partner ingrained in the ecosystem like us, you can confidently choose a BNPL provider that protects your brand and fits your needs.

Conclusion

Getting the payment type right on your store can have a majorly positive impact on your conversion rates. Moreover, convenient and straightforward payment options will affect customer retention rates. Empowering your customers with the options to buy now and pay later makes them feel like you're reaching out to meet their needs.

BNPL has become increasingly easier to install and set up, especially on the Shopify platform. But choosing the right service, getting integrations right, preparing communication channels, and optimizing the service is where we can help.

Want to learn more about adding a Buy Now Pay Later option to your Shopify checkout? Contact us today.