Essential Tips to Prevent eCommerce Chargebacks

Are chargebacks costing you time and money in your eCommerce business? This article provides essential tips to prevent eCommerce chargebacks. From enhancing fraud prevention to streamlining operations, learn how to protect your revenue and reputation.

Key Takeaways

-

Chargebacks can significantly impact eCommerce businesses through lost revenue and reputational damage, making understanding and prevention critical.

-

Implementing clear customer policies, effective communication, and robust fraud detection tools can greatly reduce chargeback incidents.

-

Regularly monitoring chargeback data and maintaining strong documentation are essential for identifying issues and successfully disputing chargebacks.

-

WeSupply prevents chargebacks by enhancing communication, simplifying returns, and automating policies. With tools like proactive notifications, branded tracking, and analytics-driven insights, you’ll boost trust, reduce disputes, and optimize operations. Get started with WeSupply today!

Introduction

Chargebacks are a major concern for eCommerce businesses. They happen when a customer disputes a charge on their credit card, prompting the bank or card issuer to reverse the transaction. Reasons include fraud, product dissatisfaction, or transaction misunderstandings, which can lead to a chargeback claim, chargeback fraud, merchant error chargebacks, and chargeback requests. Chargebacks happen when these issues arise.

Frequent chargebacks can drain revenue through lost sales, fees, and higher operational costs. They also harm your reputation with payment processors, potentially leading to excessive chargebacks, increased fees, or account termination.

This guide explores strategies to mitigate chargebacks, including enhancing fraud prevention, creating clear policies, improving customer service, optimizing internal processes, leveraging payment provider tools, monitoring chargeback data, and maintaining strong documentation.

Begin the journey to secure your eCommerce business against chargebacks.

Understand the Chargeback Process and Its Impact

Understanding the chargeback process is the first step toward prevention. A chargeback reverses a credit card transaction, initiated by the customer’s bank or card issuer. Disputes can be legitimate or fraudulent, the latter often called ‘friendly fraud,’ where customers dispute valid charges to get a refund while keeping the product.

Key players in the chargeback process include the customer disputing the charge, the merchant, the payment processor, and the issuing bank. The timeline starts with the customer filing a chargeback request, followed by a bank investigation, and ends with a decision on whether to reverse the charge.

Misconceptions about chargebacks can worsen the issue. Merchants often overlook triggers like unclear billing descriptors or shipping delays, prompting disputes. A high chargeback ratio may lead to losing your merchant account. Understanding these dynamics helps in managing and preventing chargebacks.

Strengthen Fraud Prevention and Detection Systems

Strengthening fraud prevention and detection systems is highly effective in preventing chargebacks. Implement multi-layered fraud prevention tools to safeguard against fraudulent transactions. Services like Address Verification Service (AVS) and Card Security Code verification help verify transaction authenticity.

Advanced security measures like 3D Secure 2.0 add an extra layer of protection by requiring customers to authenticate their identity during transactions, reducing fraud risks. Real-time order validation and risk scoring can identify high-risk transactions before processing.

Using fraud prevention services like Stripe Radar, Verifi, and Ethoca enhances your defenses. Utilizing Account Updater services prevents failed transactions, reducing chargeback likelihood. Integrating these tools and practices creates a robust fraud prevention strategy.

Create Clear, Customer-Friendly Policies

Transparent, customer-friendly policies are your first defense against chargebacks. Precise and informative product descriptions prevent misunderstandings that lead to disputes. An accessible refund policy encourages customers to request refunds directly from you instead of opting for chargebacks.

Clear communication about billing details helps customers recognize charges on their statements, reducing disputes over unrecognized transactions. Effective customer service resolves issues before they escalate. Provide multiple contact channels and train your team to handle disputes efficiently.

Tracking and verifying shipping information provides proof of delivery to defend against non-delivery chargebacks. For subscription services, clear communication about billing cycles and cancellation processes mitigates disputes over unexpected charges. Simplifying the return process and promoting these policies effectively reduces chargeback risks.

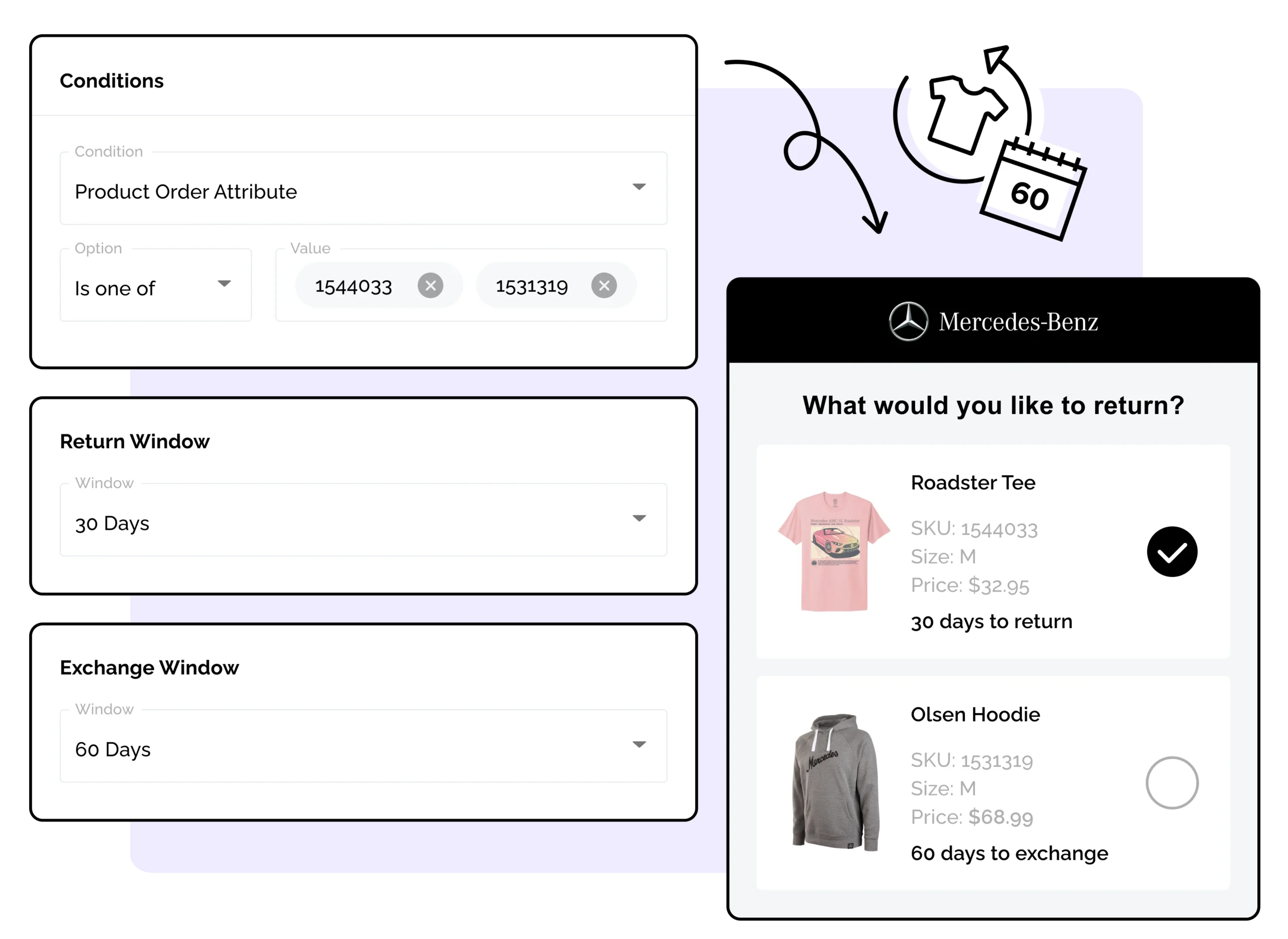

Prevent Chargebacks with Clear, Customizable Policies by WeSupply

WeSupply empowers eCommerce businesses to prevent chargebacks by creating transparent, flexible, and automated return policies. By giving you control over every aspect of returns, WeSupply ensures customer satisfaction while minimizing disputes and operational challenges.

Key Features:

-

Custom Return Policies: Tailor policies to suit your needs, including:

-

Handling final sale items.

-

Setting return window lengths.

-

Configuring return request approval processes.

-

-

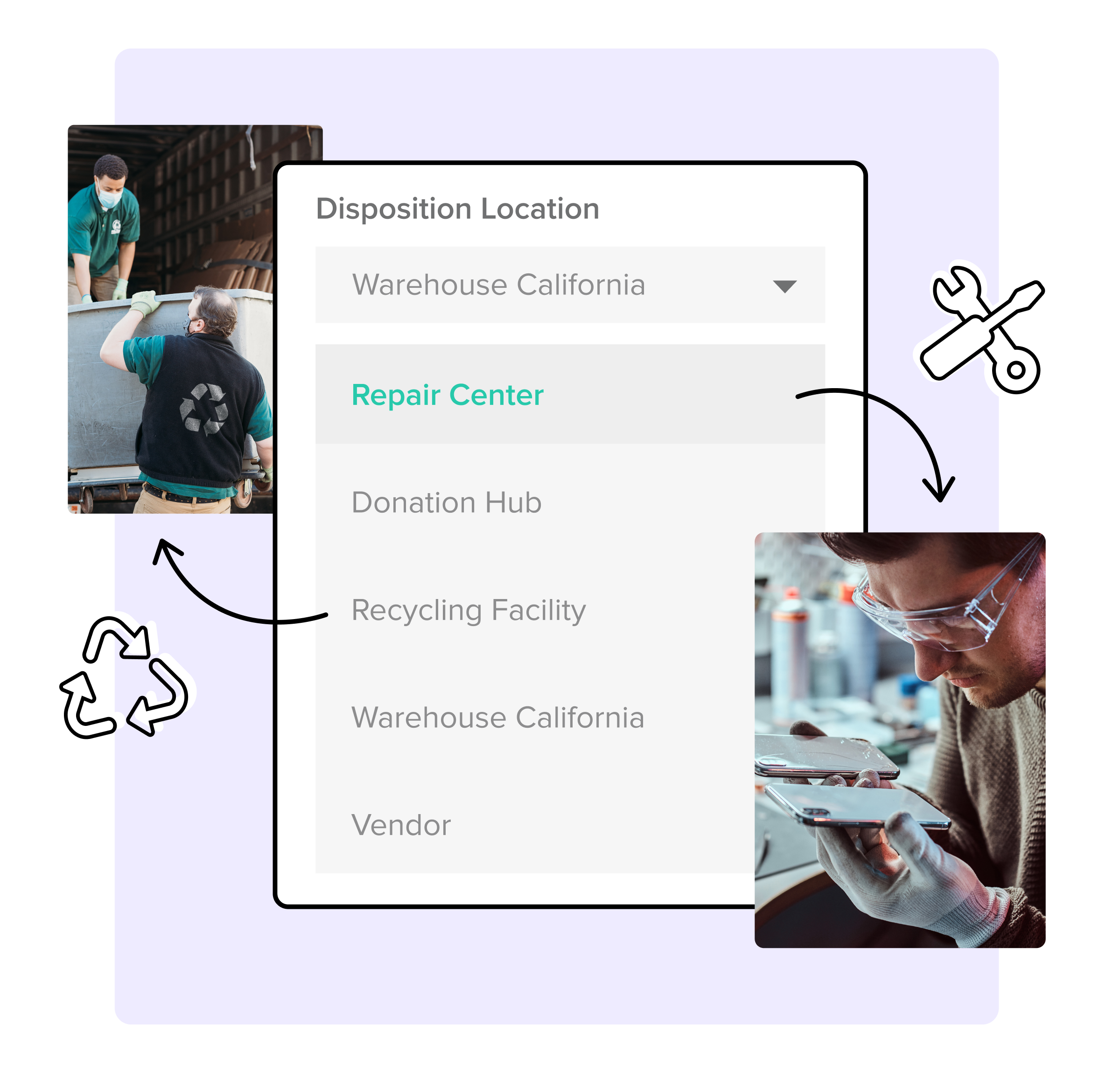

Controlled Return Destinations: Direct returned products to the right location, including:

-

East Coast hubs.

-

West Coast 3PL centers.

-

Canadian warehouses, repair centers, or donation facilities.

-

-

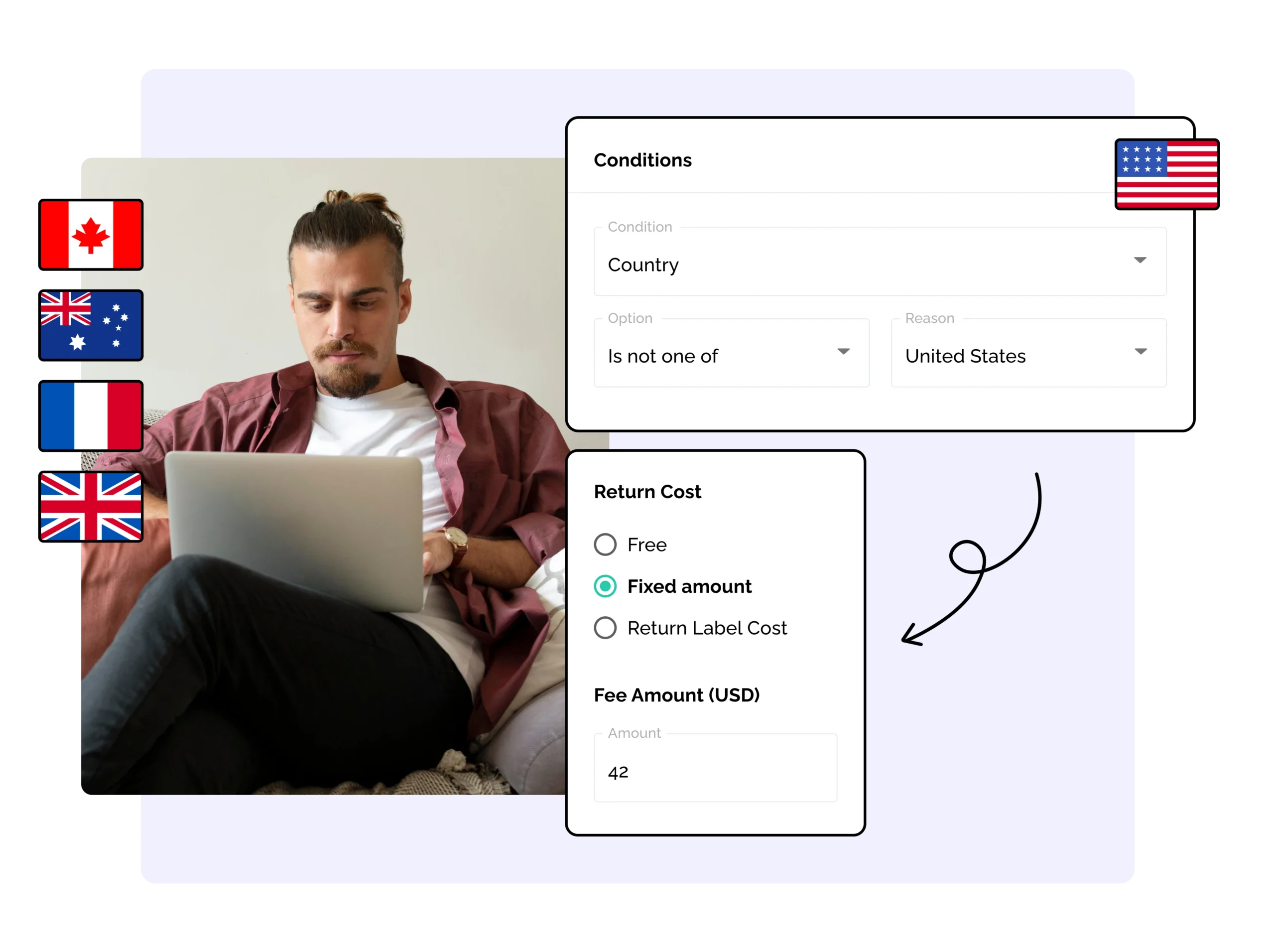

International Returns and Regional Rules: Customize policies for different regions with options to:

-

Assign specific return addresses.

-

Charge shipping for returns from certain countries.

-

Restrict returns entirely for specific regions if necessary.

-

-

Policy Enforcer: Automate complex return policies with features to:

-

Approve or reject returns based on preset conditions.

-

Flag specific returns for manual review, ensuring adherence to your policy.

-

With WeSupply’s configurable tools and automation, you can create fair and clear policies that reduce confusion, enhance customer trust, and prevent chargebacks effectively.

Simplify Returns for Your Customers and Support Team

Book a quick call with our experts to see how WeSupply can help you: simplify the Return experience with just a few clicks, reduce customer service calls and manual processing, notify your customer about their refund, automate returns and reduce user error.

Improve Customer Communication and Service

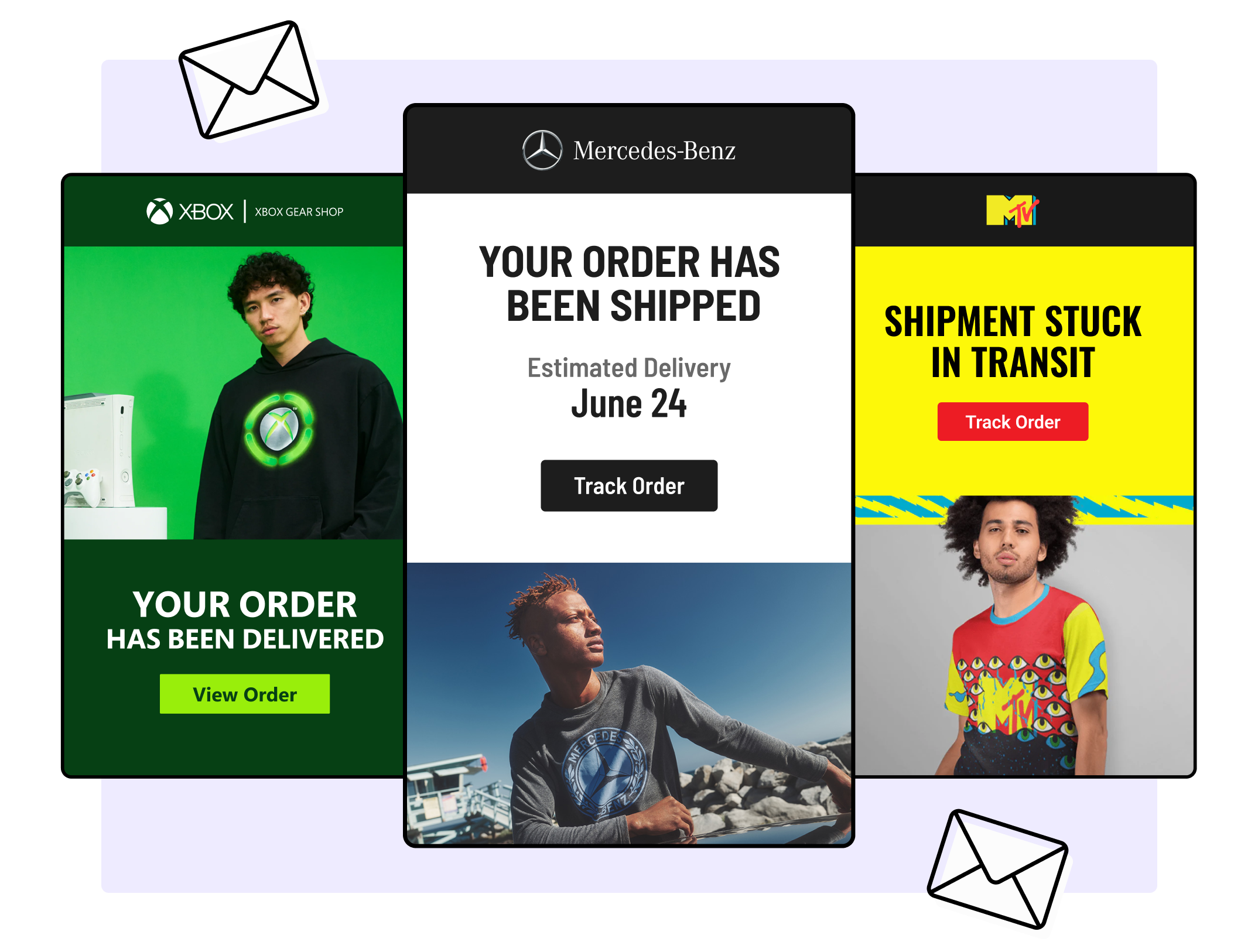

Effective communication and excellent customer service reduce chargebacks. Proactive measures like sending confirmation emails and tracking updates keep customers informed and satisfied. Clear, recognizable billing descriptors on credit card payments statements prevent disputes over unrecognized transactions.

Detailed product descriptions and images ensure customers know what they are purchasing, reducing dissatisfaction. Training your customer service team to resolve issues quickly and effectively prevents disputes from escalating to chargebacks.

Empowering customer service representatives to make decisions prevents small issues from becoming significant disputes. Offering multiple contact channels, such as phone, chat, and email, ensures customers can reach you easily, reducing frustration and potential disputes. Prioritizing customer satisfaction and clear communication helps prevent chargebacks.

Prevent Chargebacks with Better Communication and Service

WeSupply helps eCommerce businesses prevent chargebacks by enhancing customer communication and providing exceptional post-purchase service. By leveraging WeSupply’s tools, you can streamline operations, reduce disputes, and boost customer satisfaction:

- Proactive Notifications: Automatically send order confirmation emails, tracking updates, and delivery notifications to keep customers informed and reassured.

-

Branded Tracking Pages: Provide a centralized, branded platform for customers to track orders, eliminating the need for third-party services and enhancing transparency.

-

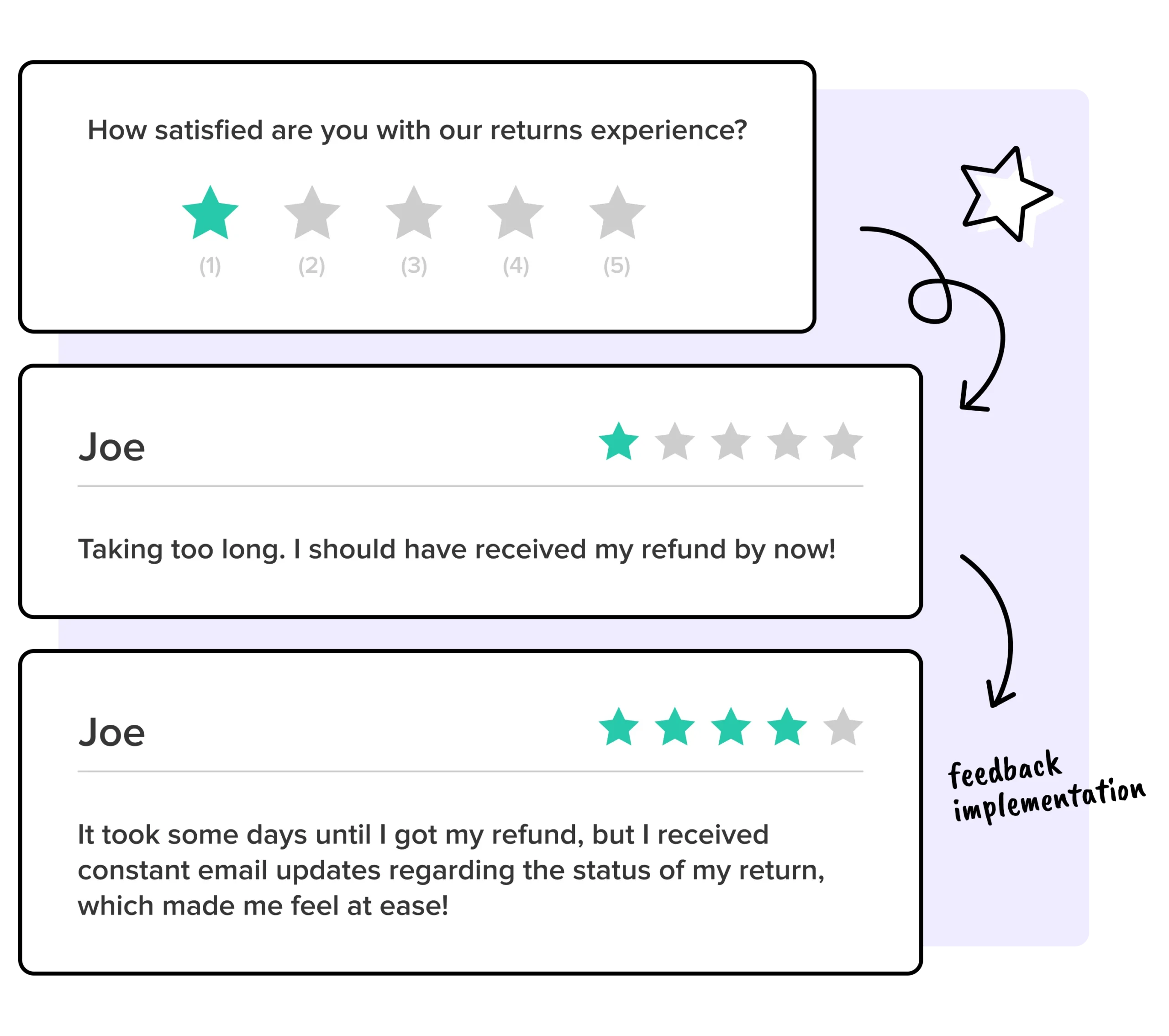

SKU-Level Returns Analytics: Gain insights into return reasons at the product and variant level, allowing you to:

-

Adjust sizing charts to minimize product fit issues.

-

Update product images to set accurate expectations.

-

Identify products that need additional reviews to guide customers better.

-

Collect actionable feedback to refine product offerings.

-

-

Customer Feedback Tools: Use CSAT and NPS integration to gather real-time feedback, identifying and addressing pain points before they lead to disputes.

-

Automated Communication Workflows: Ensure consistent and clear messaging throughout the customer journey with automated notifications, reducing confusion and potential chargebacks.

With WeSupply, businesses can foster trust, improve customer experiences, and significantly reduce the risk of chargebacks through effective communication and service.

Optimize Internal Systems to Prevent Merchant Errors

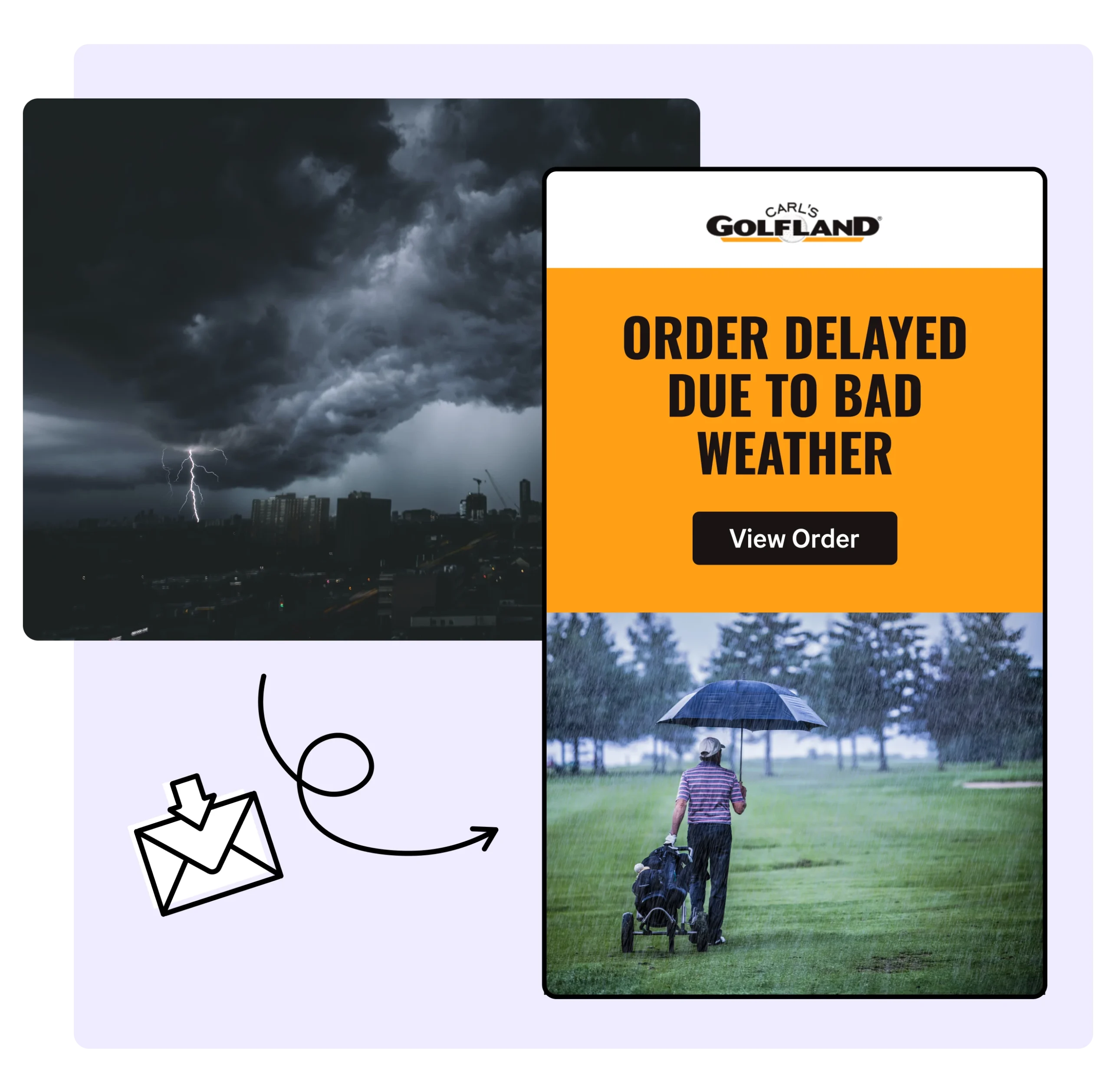

Optimizing internal systems prevents merchant errors that lead to chargebacks. Automating order processing and other error-prone tasks reduces mistakes. Monitoring delivery times and managing customer expectations keeps customers well-informed about their orders.

Real-time tracking reduces customer anxiety and addresses potential issues preemptively. Regularly auditing your systems and processes identifies and rectifies weak points, preventing errors that could trigger chargebacks.

Delaying billing until the order is shipped avoids confusion and disputes over charges for undelivered goods. Optimizing these internal processes minimizes errors leading to chargebacks and ensures a smoother customer experience.

Leverage Payment Providers and Prevention Tools

Collaborating with your payment providers is an effective strategy for chargeback prevention. Work with your payment processor to implement robust prevention measures. Utilize prevention alerts and dispute management tools to stay ahead of potential issues.

Understanding chargeback reason codes lets you tailor strategies to address specific issues that frequently trigger disputes. Monitoring your chargeback ratios and keeping them below card brand thresholds is critical for maintaining your merchant account status.

Leveraging these chargeback management tools and working closely with your payment processor helps create a comprehensive chargeback prevention strategy, protecting your business with chargeback protection and reducing chargebacks.

Monitor and Analyze Chargeback Data

Tracking and analyzing chargeback data helps identify trends and patterns to inform prevention strategies. Regular monitoring of trends, reason codes, and patterns pinpoints systemic issues needing attention. Using data insights to adjust business practices significantly reduces chargebacks.

Adjusting product descriptions, improving service quality, and refining policies based on analysis are practical steps to mitigate chargebacks. Continuous analysis helps proactively address potential issues before they escalate into significant problems.

Maintain Strong Documentation and Evidence for Disputes

Thorough documentation and compelling evidence are crucial for effectively disputing chargebacks. Keep detailed records of orders, shipping, and all customer interactions. Proof of delivery and communication logs strengthen your case when disputing chargebacks.

Understanding best practices for winning chargeback disputes increases your chances of success. Knowing when to fight or accept chargebacks is important, as some disputes may not be worth the effort. Strong documentation and evidence help manage and reduce chargebacks effectively.

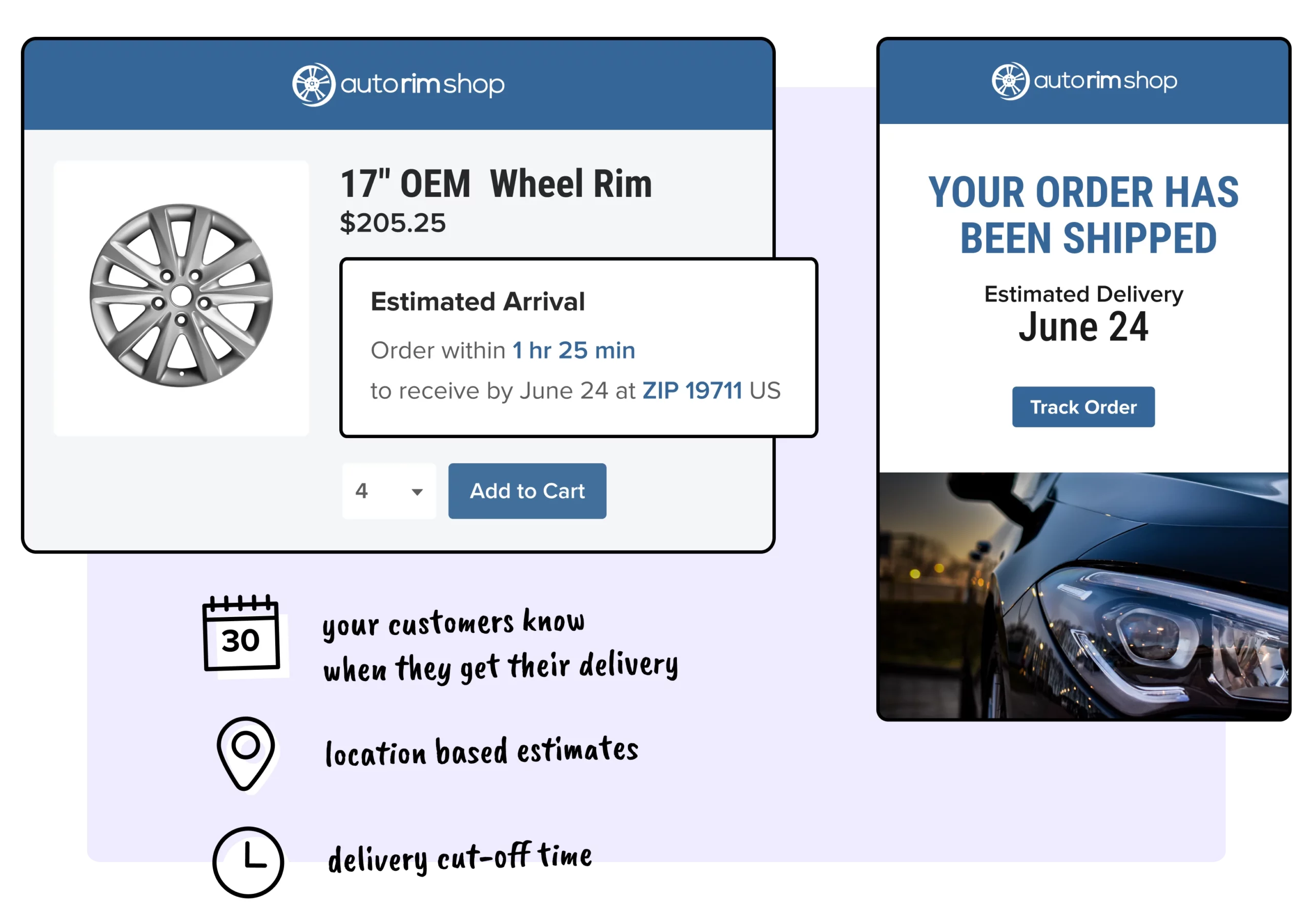

Manage Customer Expectations Throughout the Journey

Managing customer expectations from purchase to post-delivery prevents disputes. Provide upfront product specifications and clear shipping timelines to set accurate expectations. Proactively communicate delays and send follow-up emails to confirm customer satisfaction.

These practices minimize disputes and chargebacks by keeping customers informed and satisfied throughout their journey.

Managing Expectations Beyond Purchase with WeSupply

Managing customer expectations doesn’t end at the moment of purchase—it’s just the beginning. Post-purchase communication is critical to maintaining trust, preventing misunderstandings, and reducing eCommerce chargebacks. That’s where WeSupply steps in, offering tools to keep your customers informed, reassured, and loyal throughout their entire journey.

Key WeSupply Features:

- Estimated Delivery Date: Set clear expectations with embedded delivery dates, eliminating shipping anxiety and enhancing trust.

-

Order Tracking: Provide real-time tracking updates, empowering customers with accurate shipment details to prevent confusion and mitigate inquiries.

-

Delivery Notifications: Proactively inform customers of shipping updates or delays to address concerns before they arise, minimizing disputes.

- Branded Tracking Pages: Enhance the post-purchase experience with a fully branded tracking portal that eliminates the need for third-party tracking, offering a unified and transparent customer journey.

By keeping customers informed and engaged throughout their purchase journey, WeSupply helps you build long-term loyalty, reduce friction, and avoid chargebacks effectively.

Combat inconvenience with proactivity & self service

Book a quick call with our experts to see how WeSupply can help you make returns easy for your customers with a beautiful, self-service solution that makes their experience easier while also providing new ways to lower costs and earn back revenue.

Conclusion

Recap the top chargeback prevention strategies discussed. Emphasize the importance of balancing prevention measures with maintaining a positive customer experience.

Encourage readers to regularly review their systems, stay proactive, and protect their eCommerce business from chargebacks and associated financial losses.